Breaking News: PM Youth Loan Scheme 2025 – How to Check Application Status Online

PM Youth Loan Scheme

Every young Pakistani dreams of becoming financially independent and building a secure future. Rising inflation and limited job opportunities have pushed many into uncertainty. To address this, the Government of Pakistan has introduced the PM Youth Loan Scheme 2025, designed to help young men and women start their own businesses and stand on their own feet.

This scheme is not just about loans – it is a lifeline for thousands of unemployed youth across the country. But after applying, most people feel confused about what happens next: Has my application been approved? How can I check my loan status? In this article, you’ll find a complete and practical guide to track your application status without hassle.

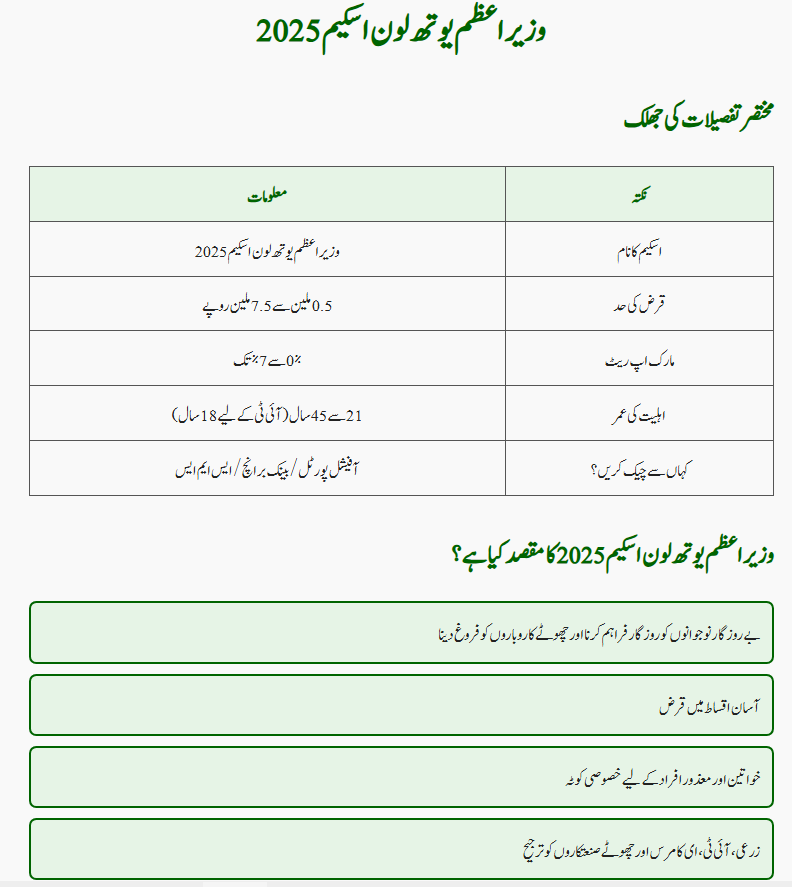

Quick Details Overview

| Point | Information |

| Scheme Name | PM Youth Loan Program 2025 |

| Loan Amount | PKR 0.5 million – 7.5 million |

| Markup Rate | 0% – 7% |

| Eligible Age | 21 to 45 years (18 years for IT) |

| How to Check Status | Official portal / Bank branch / SMS |

What Is the Purpose of PM Youth Loan Scheme 2025?

The main goal of this scheme is to support unemployed youth, small traders, and young entrepreneurs. Instead of waiting for jobs, the government encourages youth to create jobs by starting businesses.

- Easy loan installments with low interest rates.

- Reserved quotas for women and differently-abled persons.

- Priority for agriculture, IT, e-commerce, and small industries.

- Multiple banks across Pakistan are participating.

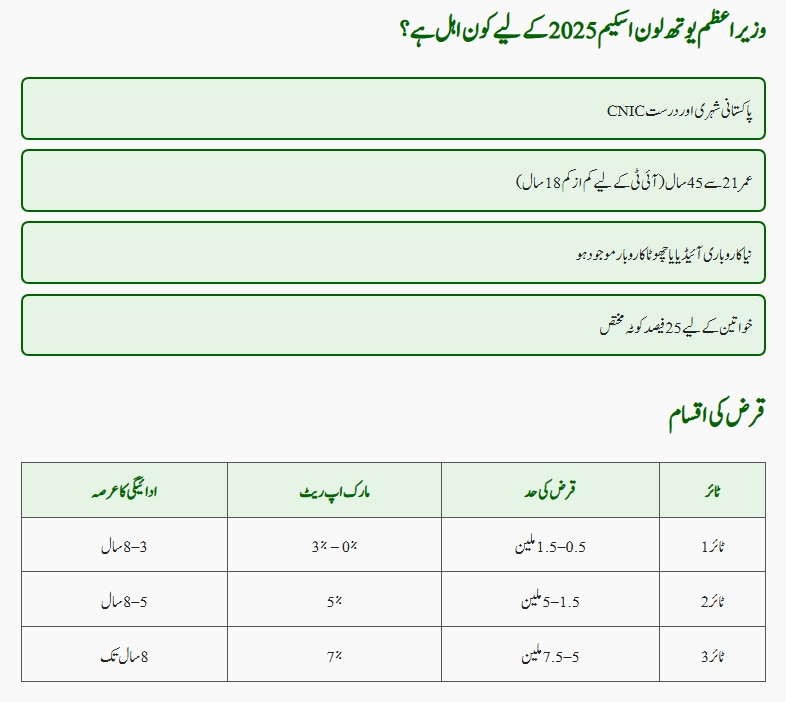

Who Can Apply for the PM Youth Loan Scheme 2025?

To be eligible, you must meet the following conditions:

- Must be a Pakistani citizen with a valid CNIC.

- Age between 21 and 45 years (minimum 18 years for IT-related startups).

- Must have a new business idea or already running a small business.

- Both men and women can apply, with 25% quota reserved for women.

Loan Categories Under PM Youth Loan Scheme 2025

| Tier | Loan Range | Markup Rate | Repayment Period |

| Tier 1 | 0.5 – 1.5 million PKR | 0% – 3% | 3 – 8 years |

| Tier 2 | 1.5 – 5 million PKR | 5% | 5 – 8 years |

| Tier 3 | 5 – 7.5 million PKR | 7% | Up to 8 years |

This tier system ensures that both small shop owners and medium-scale entrepreneurs can benefit.

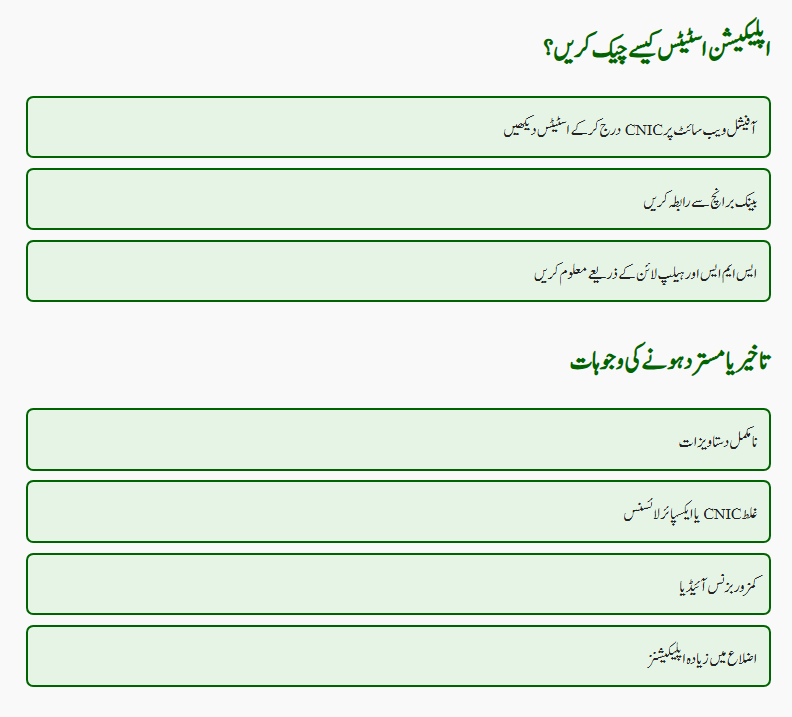

How to Check PM Youth Loan Application Status?

Many applicants get worried after applying because they don’t know the next step. Here are three simple ways to track your loan application:

1. Through the Official Website

- Visit the PM Youth Loan portal.

- Enter your CNIC in the “Application Status” section.

- You will instantly see if your application is Under Review, Approved, or Rejected.

2. Via the Bank Branch

- Visit the bank where you submitted your application.

- Provide your CNIC or application number.

- Bank staff will update you on your file progress.

3. SMS and Helpline Support

- Some banks send SMS updates when your file moves forward.

- You can also call the scheme’s helpline for confirmation.

Why Do Applications Get Delayed or Rejected?

Applications may face delays or rejection for several reasons:

- Missing documents (bank statements, business plan, etc.).

- Incorrect CNIC details or expired licenses.

- Weak business idea without clear financial feasibility.

- High number of applications in certain districts.

To avoid issues, double-check all details before submission.

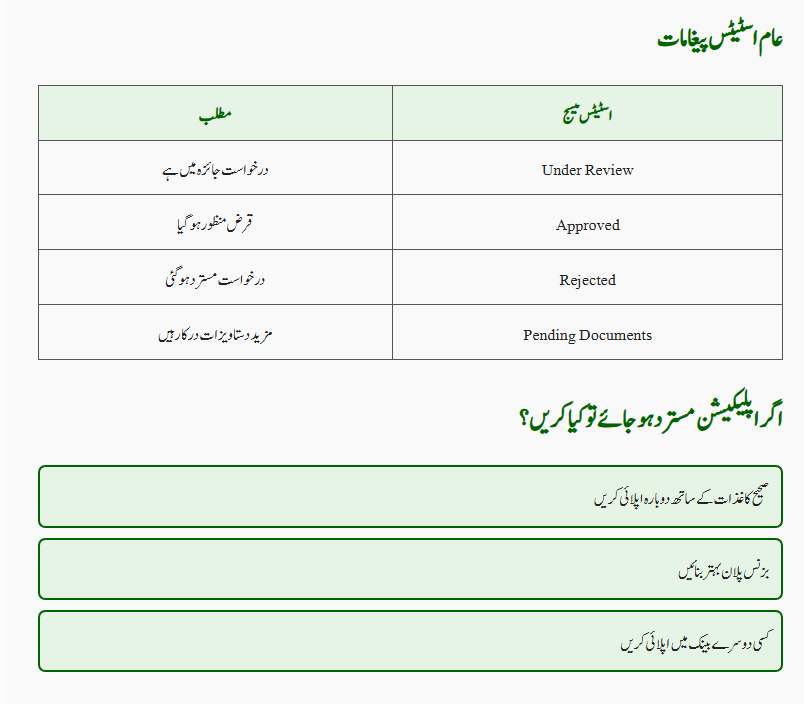

What Do Common Application Status Messages Mean?

| Status | Meaning |

| Under Review | Your application is being checked by the bank. |

| Approved | Your loan has been sanctioned and will be disbursed soon. |

| Rejected | Your application did not meet requirements. |

| Pending Documents | You need to submit additional papers. |

What If My Application Gets Rejected?

Rejection does not mean the end of your journey. You can:

- Reapply with correct documents.

- Improve your business plan with realistic profit estimates.

- Try another participating bank for better chances.

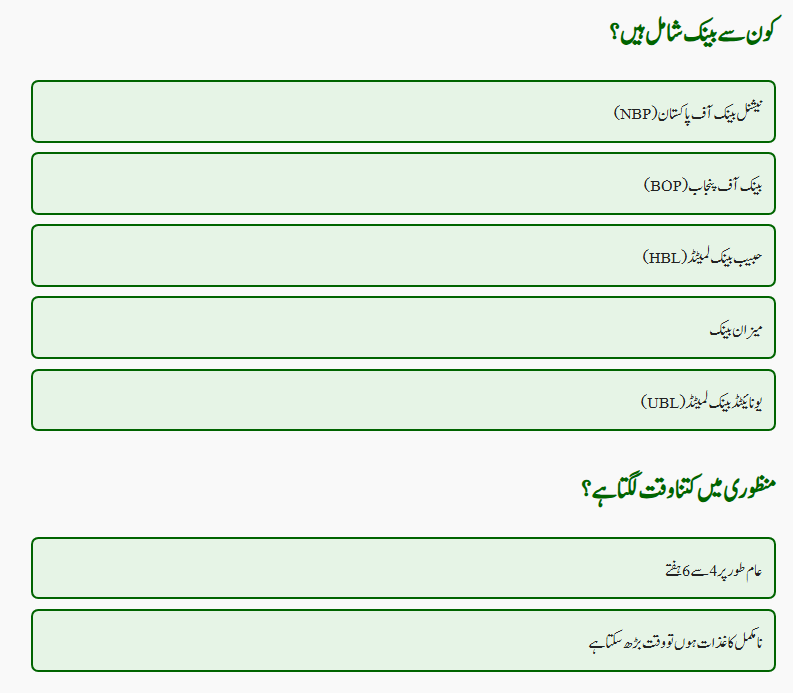

Which Banks Are Handling the PM Youth Loan Scheme 2025?

Several major banks are part of this scheme, including:

- National Bank of Pakistan (NBP)

- Bank of Punjab (BOP)

- Habib Bank Limited (HBL)

- Meezan Bank

- United Bank Limited (UBL)

You can apply through the nearest branch.

How Long Does It Take for Approval?

Normally, it takes 4 to 6 weeks for the bank to process applications. If documents are missing, it may take longer. Patience is key, and regular follow-ups with your bank branch can speed things up.

Practical Tips for Applicants

- Keep photocopies of all documents you submit.

- Present a realistic business plan, not an exaggerated one.

- Stay in regular contact with your bank branch.

- If rejected, correct mistakes and reapply without losing hope.

Conclusion

The PM Youth Loan Scheme 2025 is more than just a loan – it is a gateway to financial independence for Pakistan’s youth. By supporting entrepreneurship, the scheme helps create jobs and strengthens the economy. If your application is delayed or rejected, don’t give up. Stay updated, fix mistakes, and try again. With determination and persistence, success is within reach.

Frequently Asked Questions (FAQs)

1. How can I check my PM Youth Loan Scheme 2025 application status?

You can check online at the official PM Youth Program portal, via your bank branch, or through SMS/helpline support.

2. How much loan can I get under this scheme?

You can apply for loans ranging from PKR 0.5 million to 7.5 million, depending on your business needs.

3. Do I need collateral for the loan?

Collateral requirements vary by tier and bank, but Tier 1 usually requires little or no collateral.

4. How long does the loan approval process take?

It typically takes 4 to 6 weeks, depending on document verification and bank workload.

5. Can women apply for the PM Youth Loan Scheme 2025?

Yes, 25% of the quota is reserved for women applicants, and they are strongly encouraged to apply.