Best Credit Card in Pakistan

In today’s modern world, it’s almost impossible to imagine life without financial facilities. Whether it’s shopping, online payments, or emergencies, credit cards have become an easy and reliable solution everywhere. With rising inflation and changing financial conditions in Pakistan, people are now looking for options that are not only safe but also help them save money. That is why one of the most searched questions in 2025 is: Which is the best credit card in Pakistan, and which one offers the best cashback deals?

Choosing the right credit card can make your life much easier. Whether you love traveling, prefer online shopping, or just want to save on your everyday expenses, having the right card can be a game-changer for your financial future.

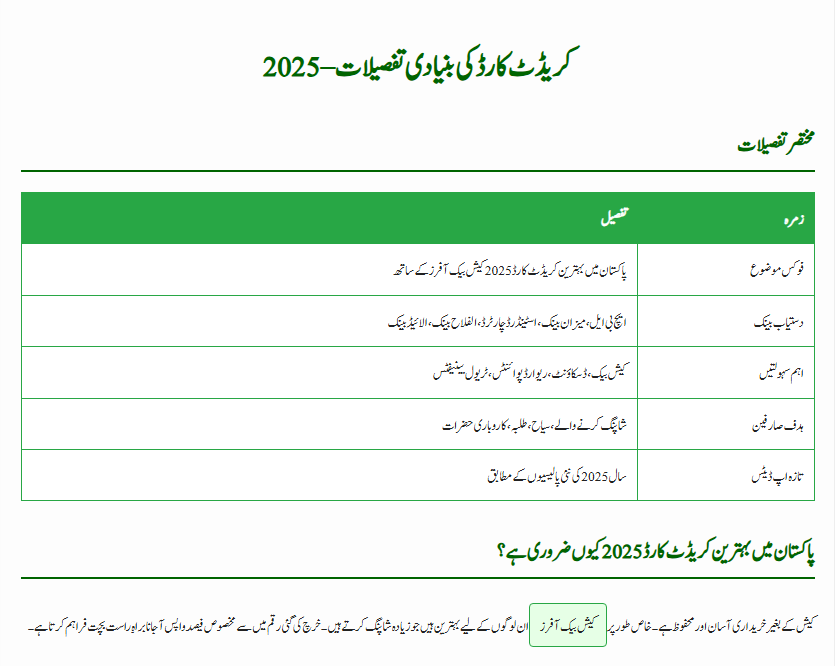

Quick Details

| Category | Details |

| Focus Topic | Best Credit Card in Pakistan 2025 with Cashback Offers |

| Popular Banks | HBL, Meezan Bank, Standard Chartered, Bank Alfalah, Allied Bank |

| Key Benefits | Cashback, Discounts, Reward Points, Travel Perks |

| Target Users | Shoppers, Travelers, Students, Business Owners |

| Latest Updates | Based on 2025 bank policies |

Why is the Best Credit Card in Pakistan 2025 Important?

Cashless shopping is no longer a luxury — it’s a necessity. A credit card allows you to pay instantly and then settle the bill with your bank later. Cashback offers are especially attractive for those who shop frequently because they directly save money. For example, if you spend 100 rupees, a certain percentage is returned to your account. This simple benefit makes cashback cards one of the most popular choices in 2025 for Pakistanis who want maximum value.

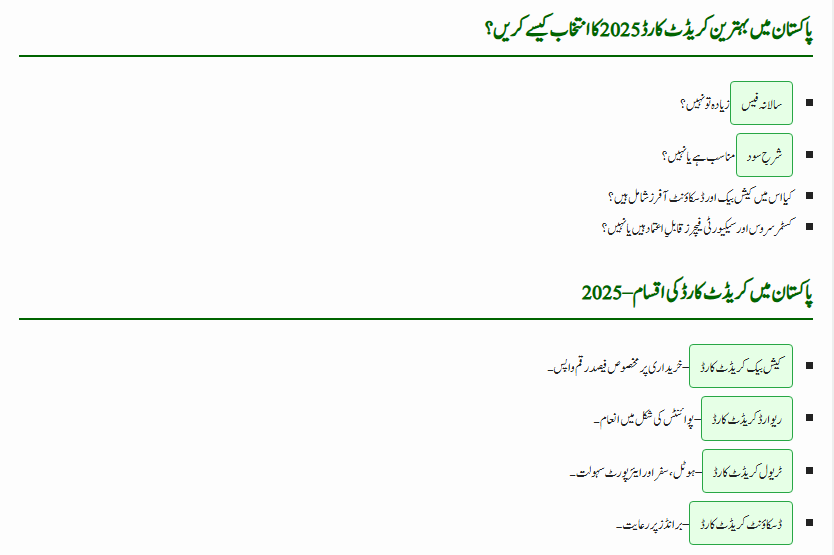

How to Choose the Best Credit Card in Pakistan 2025?

Before selecting a credit card, consider these points:

- Is the annual fee high or low?

- Is the interest rate reasonable?

- Does it offer cashback and discount deals?

- Are the bank’s customer service and security features reliable?

If a card meets these requirements, it’s likely the right choice for you.

Types of Credit Cards in Pakistan 2025

In Pakistan, banks offer different kinds of credit cards. The main types include:

- Cashback Credit Card – Gives back a percentage of your spending.

- Reward Credit Card – Earn points or miles that can be redeemed later.

- Travel Credit Card – Benefits for flights, hotels, and airport lounge access.

- Discount Credit Card – Exclusive deals with partner stores and brands.

In 2025, cashback credit cards are the most in demand because they provide direct financial benefits.

Read More: Petrol Prices Set to Rise

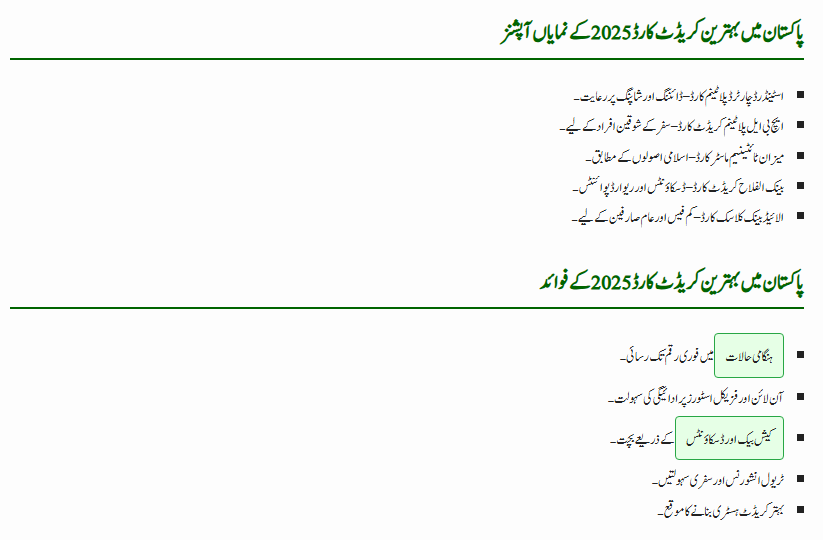

Best Credit Card Options in Pakistan 2025

Here are some of the most popular credit card options offered by banks in Pakistan:

- Standard Chartered Platinum Card – Special discounts on dining and shopping.

- HBL Platinum Credit Card – Great for frequent travelers and big spenders.

- Meezan Titanium MasterCard – Shariah-compliant card option.

- Bank Alfalah Credit Card – Packed with reward points and partner discounts.

- Allied Bank Classic Card – Low fee and suitable for everyday users.

Benefits of the Best Credit Card in Pakistan 2025

A credit card is more than just a payment tool; it offers several advantages, including:

- Quick access to money in emergencies.

- Safe payments at both online and physical stores.

- Direct savings through cashback and discounts.

- Travel insurance and perks for frequent flyers.

- Helps build a positive credit history for the future.

Read More: 80 Electric Buses to Hit Rawalpindi Roads in October

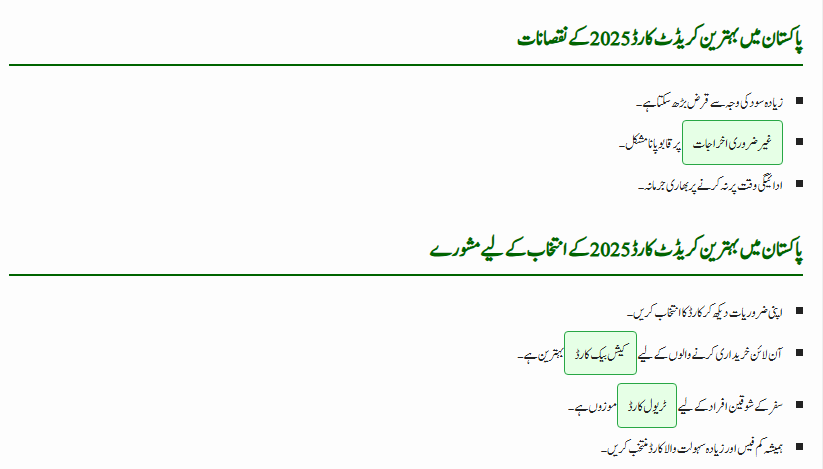

Drawbacks of Credit Cards in Pakistan 2025

While credit cards offer many benefits, they also have risks if not used carefully:

- High interest rates can increase your debt.

- Difficult to control unnecessary spending.

- Heavy penalties if payments are delayed.

That’s why it’s important to use your credit card responsibly.

Read More: Apply Online for New Domestic Gas Connection 2025

Tips for Choosing the Best Credit Card in Pakistan 2025

- Always match the card to your lifestyle and needs.

- If you shop online frequently, go for a cashback card.

- Travelers should choose a travel-focused card.

- Prefer cards with low fees but maximum benefits.

Conclusion

To sum up, the Credit Card in Pakistan 2025 with Cashback Offers is an essential financial tool for anyone who wants to save money while enjoying convenience. Cashback, discounts, and reward points not only reduce your expenses but also provide financial freedom. The key is to choose wisely and use your card responsibly so it works for you — not against you.

Read More: October 1 Public Holiday Announced

FAQs

Q1: Which is the best cashback credit card in Pakistan 2025?

A: The Standard Chartered Platinum and HBL Platinum cards are among the top options due to their strong cashback and discount offers.

Q2: Can students in Pakistan get a credit card in 2025?

A: Yes, many banks offer student-friendly cards, often linked with parents’ accounts or with limited credit limits.

Q3: Are cashback credit cards really worth it?

A: Yes, if you shop regularly, cashback cards save you money by returning a percentage of your spending directly to your account.

Q4: Which bank in Pakistan offers the lowest credit card fees?

A: Allied Bank and Meezan Bank are known for offering low-fee cards while still providing useful benefits.

Q5: How can I apply for the best credit card in Pakistan 2025?

A: You can apply directly through the bank’s website, visit a branch, or contact customer service for guidance on eligibility and documentation.

Related Posts