Good News: Best Life Insurance for 50 Year Old with Diabetes 2025

Best Life Insurance for 50 Year Old with Diabetes

When someone reaches the age of 50, they start thinking more seriously about protecting their future and securing their loved ones. If that person is living with diabetes, the concern becomes even greater. Diabetes not only affects health but can also create heavy financial responsibilities. That’s why choosing the Best Life Insurance for 50 Year Old with Diabetes has become more important than ever.

Many people believe that getting life insurance with diabetes is either impossible or very expensive. But the reality is different. If diabetes is well managed and your lifestyle is healthy, you can qualify for a good life insurance plan at reasonable rates. Today, leading insurance companies are offering special policies for people with Type 1 or Type 2 diabetes to help them protect their future without financial stress.

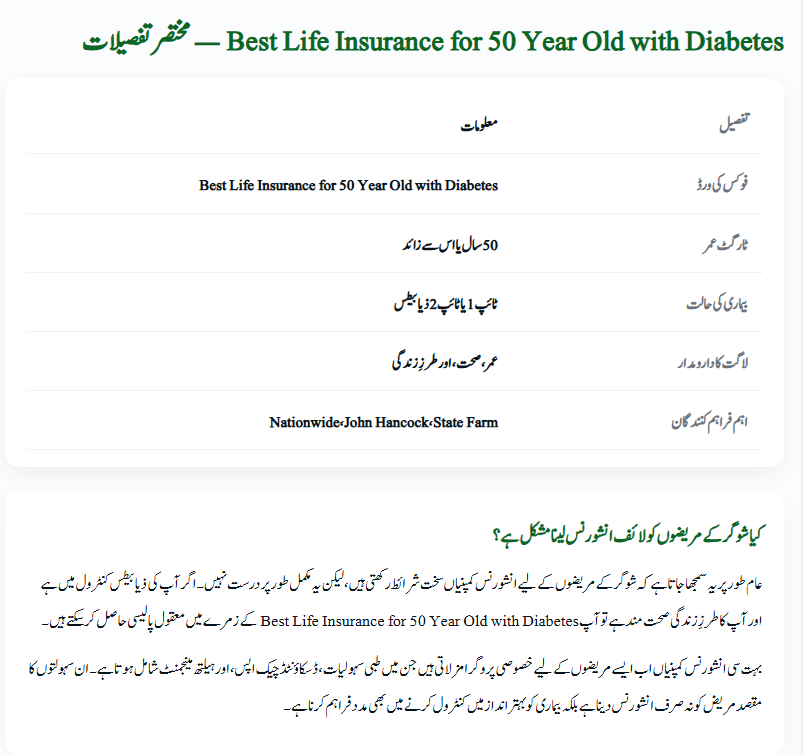

Quick Details Table

| Detail | Information |

| Focus Keyword | Best Life Insurance for 50 Year Old with Diabetes |

| Target Age | 50 years and above |

| Health Condition | Type 1 or Type 2 Diabetes |

| Cost Factors | Age, health, lifestyle |

| Top Providers | Nationwide, John Hancock, State Farm |

Is It Hard for People with Diabetes to Get Life Insurance?

It’s a common assumption that people with diabetes face strict conditions from insurance companies. But this is not entirely true. If your diabetes is under control and you maintain a healthy lifestyle, you can get the Best Life Insurance for 50 Year Old with Diabetes on fair terms.

Some companies even offer diabetes management programs that include discounted checkups, health advice, and rewards for staying active. These features are designed to support policyholders in living healthier lives while enjoying affordable coverage.

Read More: Honhaar Scholarship Phase 2, October 2025

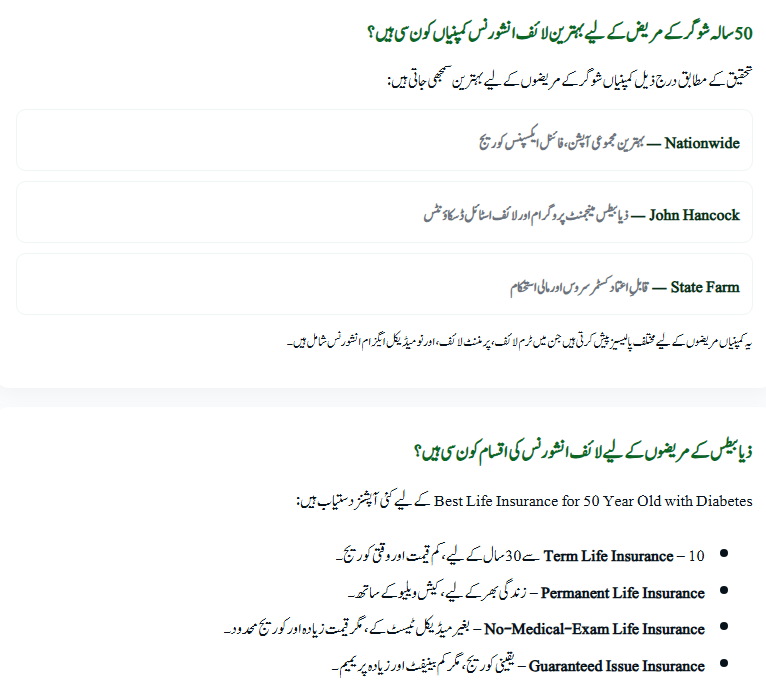

Which Life Insurance Companies Are Best for 50-Year-Olds with Diabetes?

Research shows that the following companies are considered top choices for diabetic applicants:

- Nationwide – Best overall option with strong financial stability, low complaints, and excellent final expense coverage.

- John Hancock – Known for its diabetes management program and discounts for healthy lifestyle habits.

- State Farm – Offers the strongest financial strength rating and outstanding customer satisfaction.

These companies provide a range of policies including term life, permanent life, and no-medical-exam options, making it easier for diabetic applicants to find suitable coverage.

What Types of Life Insurance Are Available for Diabetics?

The Best Life Insurance for 50 Year Old with Diabetes can fall into several categories:

- Term Life Insurance – Affordable, temporary coverage lasting 10–30 years.

- Permanent Life Insurance – Lifetime coverage with cash value benefits.

- No-Medical-Exam Insurance – Faster approval, no medical test required, but higher cost and limited coverage.

- Guaranteed Issue Insurance – Guaranteed acceptance, even with diabetes, but higher premiums and lower death benefits.

Each option has pros and cons, so the best choice depends on your health, budget, and family needs.

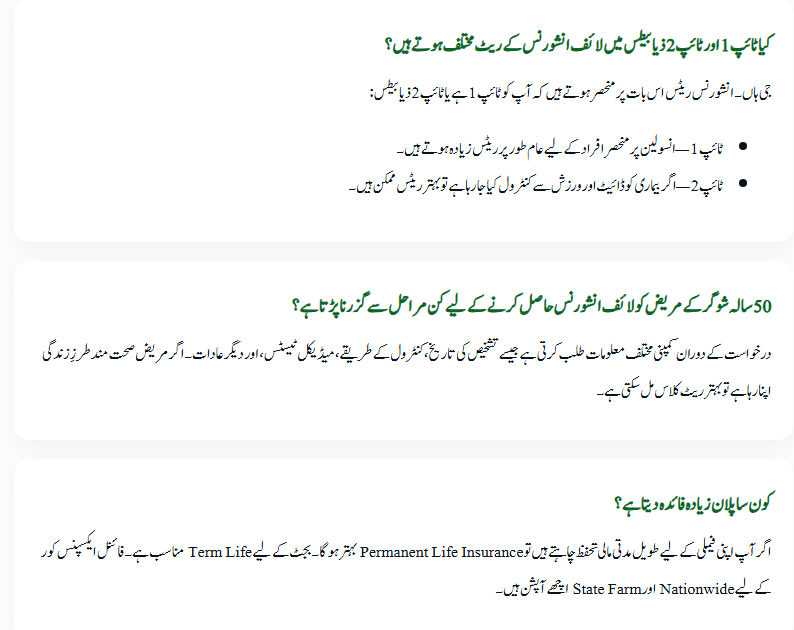

Do Rates Differ Between Type 1 and Type 2 Diabetes?

Yes, insurance rates vary based on the type of diabetes:

- Type 1 Diabetes – Since patients rely on insulin, the risk is considered higher, which often leads to more expensive premiums.

- Type 2 Diabetes – If managed with diet, exercise, and medication, applicants can qualify for lower premiums and better coverage.

Insurers will look at age, medical history, blood sugar control, and overall health before deciding the cost of your policy.

Read More: Apna Ghar Scheme Online Registration 2025

What Is the Application Process for a 50-Year-Old with Diabetes?

When applying for life insurance, companies usually ask for:

- Type of diabetes and date of diagnosis.

- How you manage your condition (insulin, medication, or lifestyle changes).

- Results of medical tests like blood sugar levels, blood pressure, and cholesterol.

- Lifestyle habits such as smoking, diet, and exercise.

If your condition is well controlled, you may qualify for a “Standard Plus” risk class, which offers better pricing than many expect.

Which Plan Is Most Useful for 50-Year-Olds with Diabetes?

If long-term security is your goal, Permanent Life Insurance is often the best option, since it provides lifelong coverage and cash value benefits.

For those on a tighter budget, Term Life Insurance offers affordable protection for a set period. Meanwhile, Final Expense Insurance is suitable for covering funeral and burial costs. Providers like Nationwide and State Farm are particularly strong choices in this area.

Read More: BISP 13500 October 2025 Payment: Check 53 Districts List

Conclusion

Life is full of uncertainties, and having life insurance is one of the best ways to protect your family—especially if you are living with diabetes. At age 50, this decision becomes even more important, because your loved ones depend on your financial stability more than ever.

Choosing the Best Life Insurance for 50 Year Old with Diabetes not only provides peace of mind but also ensures your family is financially secure after you. The key is to manage your health, live responsibly, and choose the right policy at the right time.

FAQs – Best Life Insurance for 50 Year Old with Diabetes

Q1. Can a 50-year-old with diabetes get affordable life insurance?

Yes. If diabetes is well managed and you are otherwise healthy, you can qualify for fair premiums, especially with providers like Nationwide or John Hancock.

Q2. Which life insurance company is best for diabetics?

Nationwide is considered the best overall, John Hancock is best for diabetes management, and State Farm excels in financial stability and customer satisfaction.

Q3. Does Type 1 diabetes make life insurance more expensive than Type 2?

Generally, yes. Type 1 is considered higher risk since it requires insulin, while well-managed Type 2 diabetes may qualify for lower premiums.

Q4. What type of life insurance is best for a 50-year-old diabetic?

Permanent life insurance provides lifetime coverage, but term life insurance is cheaper if you only need coverage for a set period.

Q5. Can I get life insurance without a medical exam if I have diabetes?

Yes. No-medical-exam and guaranteed issue policies are available, but they usually cost more and offer lower coverage limits.