Assan Karobar Finance Scheme 2025 – Punjab Govt Launches 2nd Phase with Interest Free Loans

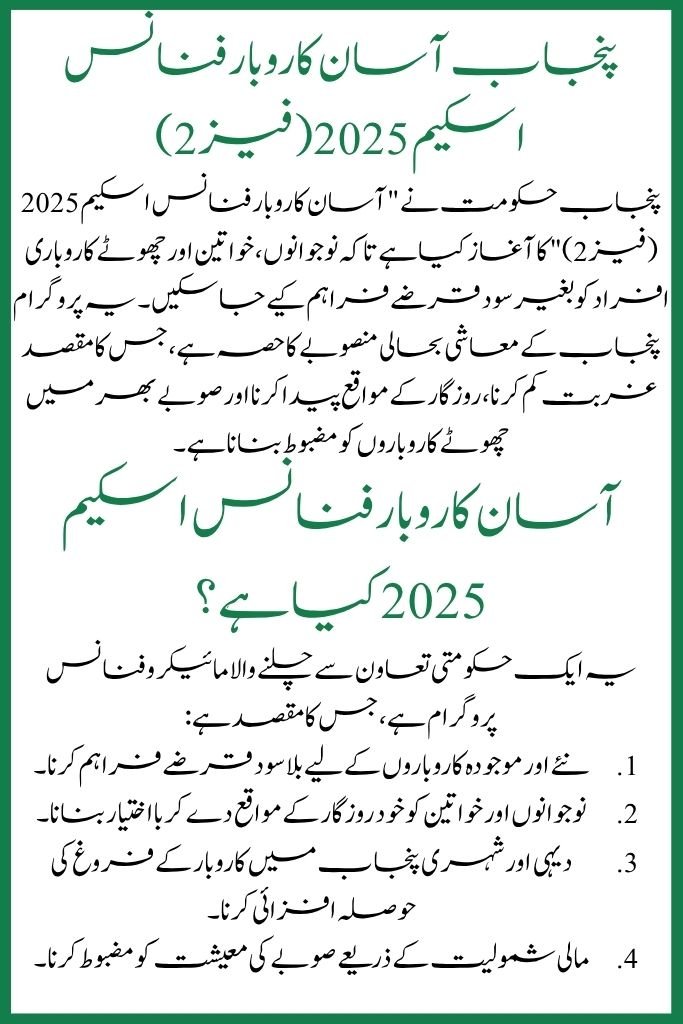

Assan Karobar Finance Scheme

The Punjab Government has launched the Assan Karobar Finance Scheme 2025 (Phase 2) to support youth, women, and small entrepreneurs with interest-free loans. This program is part of Punjab’s economic revival plan to reduce poverty, create jobs, and strengthen small-scale businesses across the province.

Also Read: Apna Ghar Scheme Online Registration 2025

What is the Assan Karobar Finance Scheme 2025?

The scheme is a government-backed microfinance program designed to:

- Provide interest-free loans for new and existing businesses.

- Empower youth and women by creating self-employment opportunities.

- Encourage entrepreneurship in both rural and urban Punjab.

- Strengthen the provincial economy through financial inclusion.

Loan Categories & Limits

| Loan Category | Amount Offered | Target Beneficiaries |

|---|---|---|

| Small Startup Loan | Rs. 50,000 – Rs. 200,000 | Youth starting new businesses |

| Expansion Loan | Rs. 200,000 – Rs. 500,000 | Small shopkeepers, vendors, SMEs |

| Growth Loan | Rs. 500,000 – Rs. 1,000,000 | Entrepreneurs & women-led enterprises |

- Repayment Period: 2–3 years (flexible installments)

- Markup: 0% (interest paid by government)

Eligibility Criteria

To apply for the Assan Karobar Finance Scheme, applicants must:

- Be a resident of Punjab with valid CNIC.

- Fall in the age group 20–50 years.

- Priority given to youth, women, differently-abled persons, and small vendors.

- Present a simple business plan or income idea.

- Not be a defaulter of any bank or financial institution.

Required Documents

Applicants should prepare:

- Copy of valid CNIC.

- Proof of residence (utility bill or rent agreement).

- Business plan (even one-page idea acceptable).

- Two guarantors (based on loan amount).

- Bank account details for disbursement.

How to Apply for Assan Karobar Finance Scheme 2025

The application process is online and transparent:

- Online Registration – Visit the official Punjab Govt portal https://www.punjab.gov.pk/asaan-karobar-finance and fill out the loan application.

- Upload Documents – Attach scanned copies of CNIC, proof of residence, and business plan.

- Verification – NADRA CNIC check, guarantor review, and business plan evaluation.

- Approval & Disbursement – Once approved, loan is transferred to the applicant’s bank account. SMS/email confirmation will follow.

Impact on Punjab’s Economy

The scheme is expected to bring major benefits:

- Youth Empowerment: More self-employment, reduced joblessness.

- Women Inclusion: Special loan quota for female entrepreneurs.

- SME Growth: Strengthens small and medium businesses.

- Rural Development: Expands financial access to villages and small towns.

Benefits at a Glance

- ✅ 0% Interest – No markup burden on applicants.

- ✅ Wide Coverage – From small vendors to women-led enterprises.

- ✅ Government-Backed – Safe, reliable, and transparent process.

- ✅ Digital System – Online application ensures transparency and less paperwork.

Conclusion

The Assan Karobar Finance Scheme 2025 is a golden opportunity for youth, women, and entrepreneurs in Punjab. With easy access to interest-free loans, the scheme encourages self-reliance, supports small businesses, and helps strengthen the overall economy. Eligible applicants should apply online to take full advantage of this program.