Mera Ghar Mera Ashiana: Home Loan Banks List

Owning a home is a dream for millions of Pakistani families, but rising property prices and expensive loans have made it nearly impossible for low-income groups. To address this challenge, the Government of Pakistan with the State Bank of Pakistan has launched the Mera Ghar Mera Ashiana Housing Loan Scheme 2025. The program allows homeless citizens to access subsidized loans with low markup, long repayment periods, and financing of up to 90%.

Loan Tier Comparison Table

| Feature | Tier 1 (T1) | Tier 2 (T2) | Notes |

|---|---|---|---|

| Maximum Loan Amount | PKR 2 million | PKR 3.5 million | Based on applicant profile |

| Fixed Markup Rate | 5% | 8% | Subsidized by government |

| Repayment Tenure | Up to 20 years | Up to 20 years | Flexible plans available |

| Loan-to-Value Ratio | 90:10 | 90:10 | Only 10% upfront |

| Processing Fees | None | None | No hidden charges |

| Prepayment Penalty | None | None | Early repayment allowed |

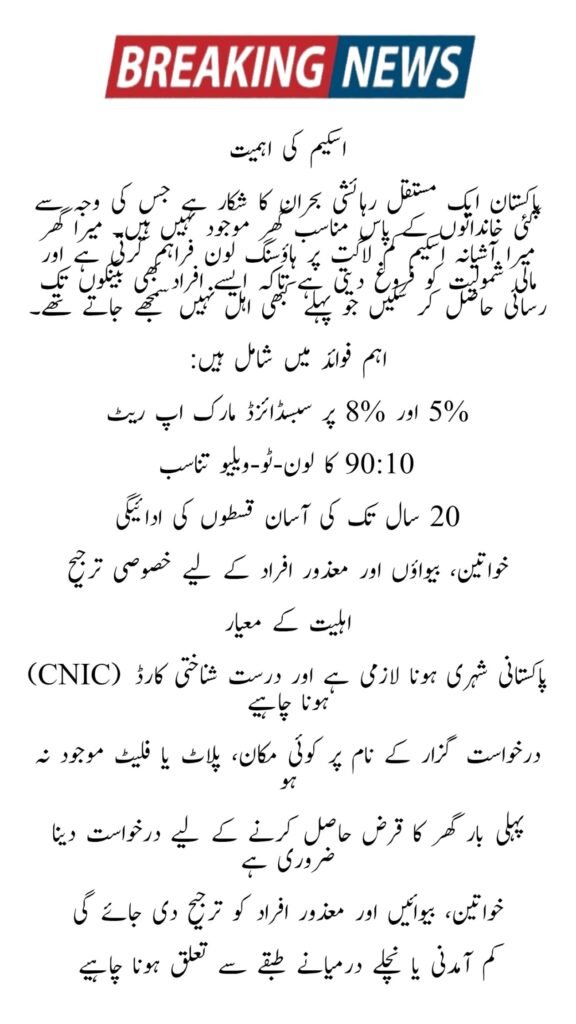

Why the Scheme Matters

This structure ensures families only contribute 10% upfront while banks finance the rest with affordable, government-subsidized markup.Pakistan faces a chronic housing shortage, leaving many families without proper homes. The Mera Ghar Mera Ashiana scheme provides affordable housing loans and promotes financial inclusion by giving access to banks for people who never qualified before.

Key advantages include:

- Subsidized markup rates of 5% and 8%

- Loan-to-value ratio of 90:10

- Repayment plans up to 20 years

- Special priority for women, widows, and differently-abled citizens

Read More:Today’s Big Update: E-Taxi Program 2025 Repayment Plan – Final Registration Date & Online Guide

Read More:PM Laptop Scheme 2025 – Phase 1 Final List Announced Big Update

Eligibility Criteria

- Must be a Pakistani citizen with valid CNIC

- Applicant must not own any house, plot, or flat

- Should be applying for a home loan for the first time

- Preference given to women, widows, and disabled persons

- Belonging to low-income or lower-middle-income households

These conditions ensure the scheme benefits families who truly need housing support.

Approved Banks and Institutions

Applicants can apply at any of the following State Bank of Pakistan–approved banks and microfinance institutions:

- Allied Bank Limited

- Askari Bank Limited

- Bank Alfalah Limited

- Bank of Punjab

- Habib Bank Limited (HBL)

- Meezan Bank Limited

- MCB Bank Limited

- National Bank of Pakistan

- Dubai Islamic Bank Pakistan Limited

- JS Bank Limited

- Faysal Bank Limited

- First Women Bank Limited

- Habib Metropolitan Bank Limited

- House Building Finance Corporation (HBFCL)

- Microfinance Banks (MFBs)

This wide network ensures accessibility even in small towns and rural areas.

Read More:Today Start New Mera Ghar Mera Ashiana Loan Scheme October 2025 Latest Update

Housing Options Covered

The scheme supports different housing needs, including:

- Purchase of a new house or flat

- Construction on owned land

- Purchase of plot plus construction

The maximum property size allowed is a 5 Marla house or 1360 sq. ft. flat.

Loan Structure and Financing

The government subsidy ensures monthly installments remain affordable. A PKR 2 million loan under Tier 1, for example, may cost less than PKR 15,000 per month—far less than standard bank loans.

Highlights of the financing structure:

- Up to 20 years repayment tenure

- No processing fees

- No early repayment penalty

- Risk-sharing model with banks

Required Documents

Applicants must submit:

- CNIC copy

- Proof of income (salary slip/business statement)

- Passport-size photographs

- Property documents (if applicable)

- Bank account details

- Completed application form

Submitting complete documents ensures faster approval.

Read More:PSER Role in AZAG Scheme – Complete Guide Today Update October 2025

Application Process

- Visit any approved bank or microfinance branch

- Request the official housing loan form

- Attach required documents and submit

- Bank verifies eligibility and credit profile

- On approval, funds are released for purchase or construction

Applicants should request a written repayment schedule to plan finances clearly.

Benefits of the Scheme

- Easy access to housing loans for first-time homeowners

- Up to 90% financing with just 10% contribution

- Subsidized markup of 5% and 8%

- Repayment period up to 20 years

- No hidden charges or penalties

- Support for women, widows, and disabled persons

- Islamic banking options available

Conclusion

The Mera Ghar Mera Ashiana Housing Loan Scheme 2025 is a breakthrough for low-income families in Pakistan. With government-backed subsidies, long repayment terms, and support from major banks, it makes home ownership achievable for thousands of citizens who never had this opportunity before. If you meet the criteria, gather your documents and apply at an approved bank to turn your dream of owning a home into reality.

Official Link: State Bank of Pakistan – Mera Ghar Mera Ashiana Scheme

FAQs

Q1: Who can apply for this housing loan?

Any Pakistani citizen with a CNIC who does not already own a home and is applying for the first time.

Q2: What is the maximum loan limit?

Up to PKR 3.5 million, depending on tier selection.

Q3: Can I use the loan to build on my land?

Yes, loans can be used for construction, house purchase, or plot plus construction.

Q4: Are there any hidden charges?

No, there are no processing fees or prepayment penalties.