How to Apply For PM Kamyab Jawan Loan 2025 – Full Guide & Eligibility

Apply For PM Kamyab Jawan Loan 2025

In Pakistan, many new people face difficulties in starting their own trades due to financial glitches. To resolve this issue, the government has launched the PM Kamyab Jawan Loan 2025, a program made for childhood to get easy advances for startups and small businesses. This guide explains all you essential to know — suitability, required documents, loan groups, and by what means to apply online stage by step.

Apply For PM Kamyab Jawan Loan– Quick Overview

| Feature | Details |

|---|---|

| Program Name | PM Kamyab Jawan Youth Loan 2025 |

| Start Date | January 2025 |

| End Date | December 2025 (applications accepted throughout the year) |

| Loan Amount | Rs. 100,000 – Rs. 7.5 million |

| Interest Rate | 0% – 7% (depends on loan tier) |

| Eligible Age | 21–45 years (18 years for IT/E-commerce startups) |

| Target Group | Students, unemployed youth, women, small entrepreneurs |

| Application Method | Online portal only |

| Supervised By | State Bank of Pakistan with partner banks |

Why the PM Kamyab Jawan Loan 2025 Matters

Key Benefits

- Financial independence: Youth can start trades without asking domestic or friends.

- Women empowerment: Female businesspersons get special support.

- Support for innovation: IT, agriculture, and e-commerce remain fortified.

- Boost to economy: More trades nasty more jobs in Pakistan.

Examples of Use

- IT graduates can set up software houses or freelancing centers.

- Young farmers can buy modern agriculture equipment.

- Businesspersons can exposed shops, plants, or facility middles.

Loan Categories Under PM Kamyab Jawan 2025

To support different business needs, the loan is divided into three tiers:

| Tier | Loan Range | Interest Rate | Repayment Duration |

|---|---|---|---|

| Tier 1 | Rs. 100,000 – Rs. 1 million | 0% | Up to 8 years |

| Tier 2 | Rs. 1 million – Rs. 5 million | 5% | Up to 8 years |

| Tier 3 | Rs. 5 million – Rs. 7.5 million | 7% | Up to 8 years |

This system helps both minor startups and average businesses similarly. For example, a alumna may need Rs. 300,000 for a shop, while an knowledgeable businessperson may need Rs. 5 zillion to expand.

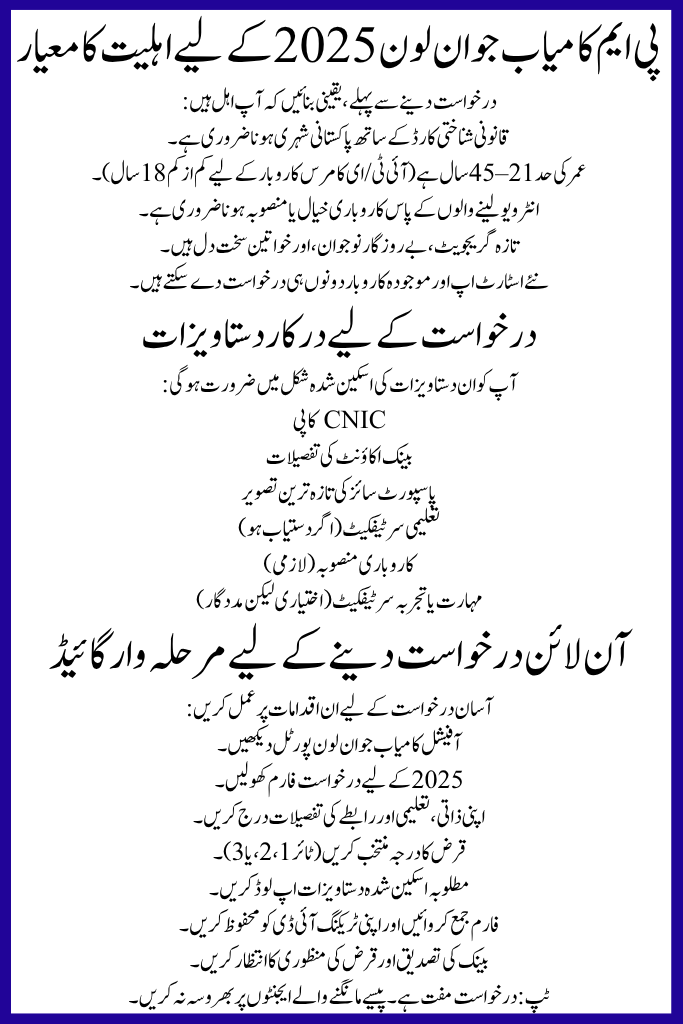

Eligibility Criteria for PM Kamyab Jawan Loan 2025

Before applying, make sure you qualify:

- Must be a Pakistani citizen with lawful CNIC.

- Age limit is 21–45 years (minimum 18 years for IT/E-commerce businesses).

- Interviewees must have a business idea or plan.

- Fresh graduates, unemployed youth, and women are strongly heartened.

- Both new startups and existing businesses can apply.

Required Documents for Application

You will need these documents in scanned format:

- CNIC copy

- Bank account details

- Latest passport-size photograph

- Educational certificates (if available)

- Business plan (mandatory)

- Skill or experience certificates (optional but helpful)

Step-by-Step Guide to Apply Online

Follow these steps for an easy application:

- Visit the official Kamyab Jawan Loan portal.

- Open the application form for 2025.

- Enter your personal, educational, and contact details.

- Select the loan tier (Tier 1, 2, or 3).

- Upload the required scanned documents.

- Submit the form and save your tracking ID.

- Wait for bank verification and loan approval.

💡 Tip: The application is free. Do not trust agents who demand money.

Common Problems Faced by Applicants

- Website may be sluggish due to heavy traffic.

- Many applicants fight to prepare a clear business plan.

- Rejections happen because of incorrect or imperfect documents.

- Bank supports sometimes take extra time.

Pro Advice: Keep your CNIC, bank info, and commercial plan ready and error-free before applying.

PM Kamyab Jawan Loan 2025 – Additional Features

- Flexible repayment: Up to 8 years.

- Low or zero interest: Tier 1 finances are interest-free.

- Government guarantee: Loans remain backed by SBP.

- Inclusive program: Women then youth are given importance.

How Youth Can Benefit Quickly

- Financial freedom: Start your own work without waiting for jobs.

- Innovation support: IT, agriculture, and services get priority.

- Local impact: New businesses create jobs in your area.

- Skill value: Education and certificates increase approval chances.

Tips to Increase Approval Chances

- Write a 1-page business plan with idea, target market, and profit.

- Make sure your documents are scanned clearly.

- Avoid mistakes in CNIC or bank account numbers.

- Apply early, especially for IT, agriculture, or e-commerce ideas.

- Keep your tracking ID safe for follow-ups.

FAQs – Apply For PM Kamyab Jawan Loan

Can women apply?

Yes, female businesspersons are fortified to apply.

What is the minimum loan amount?

Rs. 100,000 under Tier 1.

Can I apply if I already run a business?

Yes, existing businesses are also eligible.

How long does approval take?

Normally a few weeks, depending on the bank.

Is a business plan necessary?

Yes, even a simple business plan is required.

Conclusion

The Apply For PM Kamyab Jawan Loan 2025 is a excellent chance for Pakistani youth to twitch or expand their trades. With low interest, flexible repayment, and full government provision, it gives young persons the tools to go ideas into realism. Apply online, prepare your leaflets correctly, and take the first step toward becoming your own boss.