Now Get Asaan Karobar Finance Scheme 2025: Interest Free Loans up to 30 Million

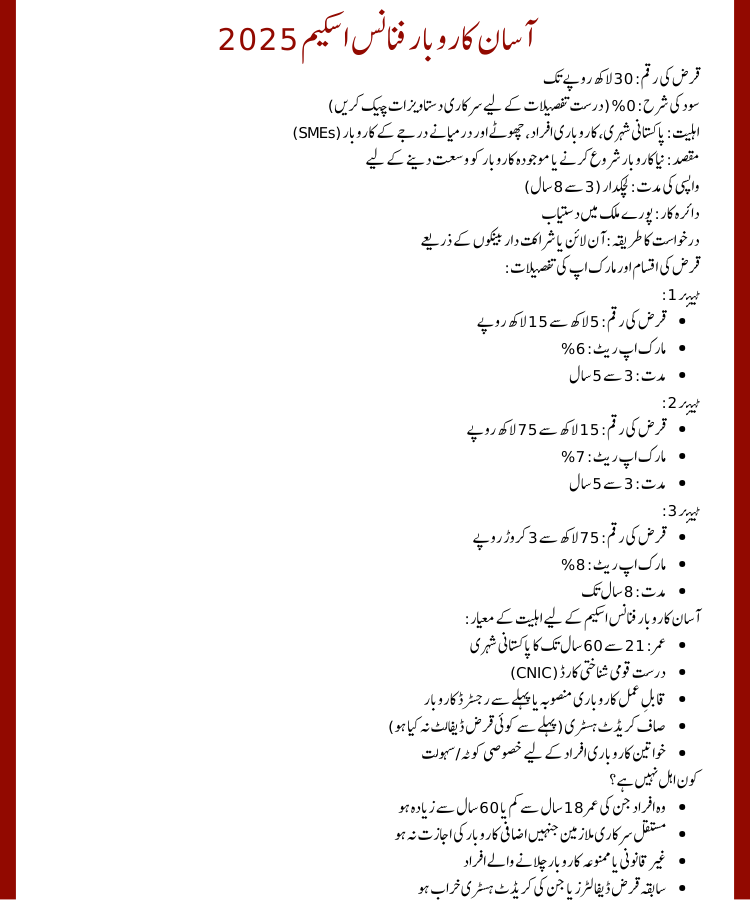

Asaan Karobar Finance Scheme

Have you ever wanted to start a business but didn’t have the funds? The Asaan Karobar Finance Scheme 2025 aims to remove that barrier by offering government-backed financing for entrepreneurs, startups and small businesses across Pakistan. It promises large, accessible loans with flexible repayment targeting youth, women entrepreneurs and small business owners who want to launch or grow their ventures.

Also Read: CM Punjab Green Credit Program 2025

What is the Asaan Karobar Finance Scheme 2025?

- Government initiative to promote entrepreneurship, job creation and financial independence.

- Designed to provide business loans with flexible terms and wide coverage across Pakistan.

- Marketed as interest-free but includes tiered markup details (see section 4).

Also Read: CM Punjab Veterinary Internship Program

Key features of Asaan Karobar Finance Scheme 2025

- Loan amount: Up to Rs. 30 million.

- Interest rate: 0% stated (check official documents for exact charges).

- Eligibility: Pakistani citizens, entrepreneurs, SMEs.

- Purpose: Start or expand businesses.

- Repayment period: Flexible (3–8 years).

- Coverage: Nationwide.

- Application: Online & through participating banks.

Loan tiers & markup details

- Tier 1 – Loan amount: Rs. 0.5M – Rs. 1.5M; Markup rate: 6%; Tenure: 3–5 years.

- Tier 2 – Loan amount: Rs. 1.5M – Rs. 7.5M; Markup rate: 7%; Tenure: 3–5 years.

- Tier 3 – Loan amount: Rs. 7.5M – Rs. 30M; Markup rate: 8%; Tenure: Up to 8 years.

Also Read: CM Punjab E-Taxi Scheme

Eligibility criteria for Asaan Karobar Finance Scheme

- Pakistani citizen aged 21–60 years.

- Valid CNIC.

- Present a feasible business plan or already-registered enterprise.

- Clean credit history (no loan defaults).

- Special quota/support for women entrepreneurs.

Who is not eligible

- Applicants under 18 or over 60 years.

- Permanent government employees without a permitted side business.

- Individuals running illegal or banned businesses.

- Previous loan defaulters with negative credit history.

Required documents

- Copy of CNIC (valid and verified).

- Business plan / feasibility report with costs and revenue forecast.

- Proof of business registration (trade license, SECP certificate, partnership deed).

- Bank statements / income proof (last 6–12 months).

- Collateral documents (property/assets) for larger loans.

How to apply

Online application method

- Visit the official portal or partner bank’s loan page.

- Fill in personal and business details.

- Upload scanned documents and submit.

- Save your tracking ID and wait for verification and approval.

- Once approved, loan is disbursed to your bank account.

Bank application method

- Apply through participating banks; bank will verify CNIC, business plan and repayment capacity.

- Participating banks commonly include:

- National Bank of Pakistan (NBP)

- Habib Bank Limited (HBL)

- Bank Alfalah

- United Bank Limited (UBL)

- Meezan Bank (Islamic option)

Common reasons for rejection

- Incomplete or invalid documents.

- Expired or unverifiable CNIC.

- Previous loan defaults or bad credit history.

- Weak or unrealistic business plan.

- Insufficient collateral for higher-tier loans.

Benefits of the Asaan Karobar Finance Scheme

- Access to large loans (up to Rs. 30M).

- Flexible repayment (3–8 years) and possible grace period.

- Special support and quotas for women entrepreneurs.

- Accessible to startups and SMEs, promoting job creation and economic growth.

Tips to improve approval chances

- Keep your CNIC updated and verified.

- Prepare a clear, detailed business plan with realistic forecasts.

- Maintain a good credit history; clear any past defaults if possible.

- Provide collateral for Tier 2 or Tier 3 loan requests.

- Double-check all application details before submission.