SBP Mera Ghar Mera Ashiana Loan Scheme 2025

The State Bank of Pakistan (SBP) has hurled the Mera Ghar Mera Ashiana Loan Scheme 2025 to assistance low- and middle-income Pakistani families buy or build their own households. Rising stuff prices and high backing costs make homeownership difficult, so this scheme provides affordable housing finance with government subsidy and low markup rates. Citizens who do not previously own a home can apply and benefit from this chance.

Quick Information Table

| Program Name | SBP Mera Ghar – Mera Ashiana Loan Scheme 2025 |

|---|---|

| Start Date | January 2025 |

| End Date | December 2025 (Applications Open Year-Round) |

| Loan Amount | PKR 2 Million – PKR 3.5 Million (Tier-Based) |

| Markup Rate | 5% (T1), 8% (T2) |

| Loan Tenor | Up to 20 Years |

| Application Method | Online & Offline via Banks |

| Eligibility | First-time homeowners, Pakistani citizens with valid CNIC |

| Participating Institutions | All Commercial Banks, Islamic Banks, Microfinance Banks, HBFCL |

What is the Mera Ghar Mera Ashiana Loan Scheme 2025?

This package is part of the administration’s affordable housing initiative, oversaw by the State Bank of Pakistan. The main objective is to provide low-cost housing finance to relations who do not own any household or flat.

Key features include:

- Administration markup subsidy for the first 10 years.

- Risk-sharing mechanism to inspire banks to lend.

- Flexible usage (buy, build, or concept on owned land).

- No hidden charges or processing fees.

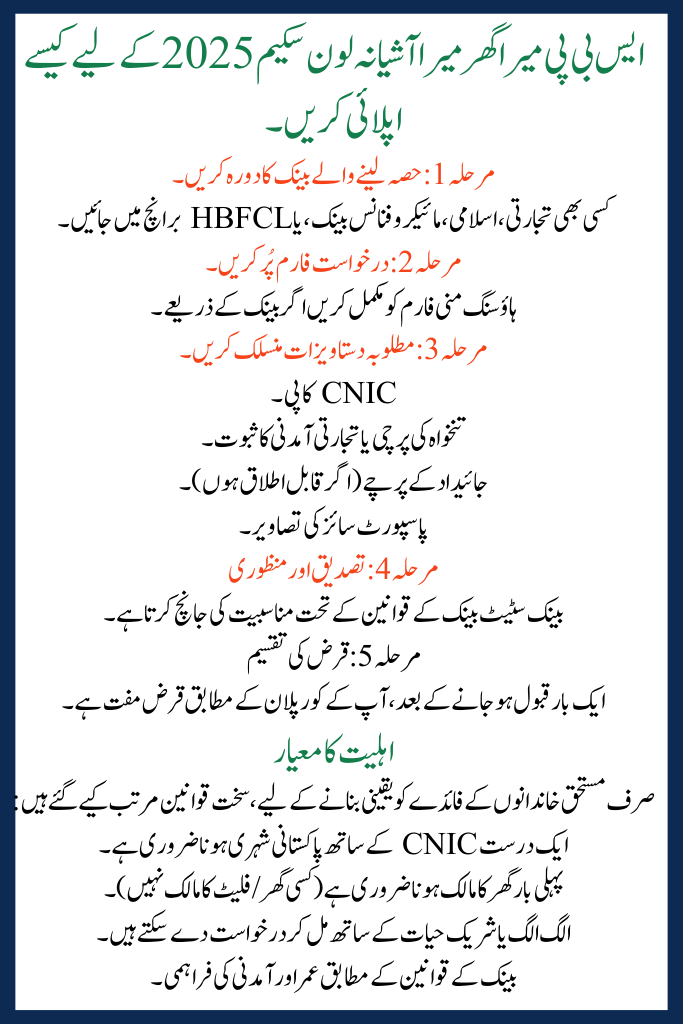

Eligibility Criteria for SBP Mera Ghar Mera Ashiana Loan Scheme

To ensure only deserving families benefit, strict rules are set:

- Necessity be a Pakistani citizen with a valid CNIC.

- Must be a first-time homeowner (not owning any house/flat).

- Can apply separately or together with a spouse.

- Age and income supplies as per bank rules.

Scope of the Loan

Applicants can use this loan for multiple housing purposes:

- Purchase of a house or flat.

- Construction of a house on an already owned plot.

- Purchase of a plot and construction of a house on it.

This flexibility makes the scheme suitable for different needs.

Size of Housing Units

The arrangement chains small and medium housing units only:

- House: Up to 5 Marla.

- Flat/Apartment: Up to 1,360 sq. ft.

This safeguards the scheme boards reasonable housing rather than luxury possessions.

Loan Amount & Tiers

The financing is divided into two tiers:

- Tier 1 (T1): Up to PKR 2.0 Million

- Tier 2 (T2): Above PKR 2.0 Million and up to PKR 3.5 Million

This tier system gives flexibility depending on budget and housing requirements.

Loan Tenor (Repayment Period)

- Maximum period: 20 years.

- Administration provides markup subsidy for the first 10 years.

- Longer payment incomes smaller monthly installments, reasonable for relations.

Pricing & Markup Rates

The biggest benefit is the subsidized markup:

- Tier 1 (T1): 5% fixed markup.

- Tier 2 (T2): 8% fixed markup.

Normally banks charge 18–22%, so this scheme is highly affordable.

Bank Charges

To keep the SBP Mera Ghar Mera Ashiana Loan Scheme fair and accessible:

- No processing fee.

- No prepayment penalty (if you want to repay earlier).

- Standard documentation charges only.

- Loan-to-Value Ratio (LTV)

The LTV ratio is 90:10, meaning:

- Bank provides 90% of the financing.

- Applicant contributes only 10% equity.

Example: If a house prices PKR 2 million, you only pay PKR 200,000 while the set covers PKR 1.8 zillion.

Risk Coverage for Banks

- Administration covers 10% of the outstanding loan portfolio on a first-loss basis.

- This decreases risk for sets and ensures flat backing for candidates.

Participating Financial Institutions

Almost all banks in Pakistan are part of this scheme:

- Commercial Banks (HBL, UBL, MCB, ABL, etc.)

- Islamic Banks (Meezan, Bank Islami, Dubai Islamic, etc.)

- Microfinance Banks (MFBs)

- House Building Finance Corporation Limited (HBFCL)

Applicants can approach any branch of these banks.

Benefits of Mera Ghar Mera Ashiana Loan Scheme

- Affordable monthly installments.

- Long tenor (20 years) for easier payments.

- Government subsidy reduces cost.

- No hidden charges or penalties.

- Flexible usage (purchase or construction).

- Wide bank network for applications.

How to Apply for SBP Mera Ghar Mera Ashiana Loan Scheme 2025

Step 1: Visit a Participating Bank

Go to any commercial, Islamic, microfinance bank, or HBFCL branch.

Step 2: Fill Out Application Form

Complete the housing money form if by the bank.

Step 3: Attach Required Documents

- CNIC copy.

- Salary slip or commercial income proof.

- Property leaflets (if applicable).

- Passport-size photographs.

Step 4: Verification & Approval

The bank checks suitability under SBP rules.

Step 5: Loan Disbursement

Once accepted, the loan is free according to your cover plan.

Conclusion

The SBP Mera Ghar Mera Ashiana Loan Scheme 2025 is a game-changer for low- and middle-income families in Pakistan. With management backing, reasonable rise, and lithe loan selections, it brands homeownership possible for thousands of citizens.

If you are a first-time buyer and vision of owning your own home, this preparation is your best chance in 2025. Prepare your leaflets early, apply through your adjacent bank, and take the first step to securing your family’s future.

For official particulars and round, visit the SBP website:

Related Posts